Do You Have To Pay Import Vat On Gifts . Vat is exempted for gift. You pay vat when you buy the goods or to the delivery company If the total value of your gift consignment does not exceed €700, a flat. — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. — if you’re making an online or oral declaration, you may have to pay import vat. — goods that have a value below £39 will be duty and tax free. what rate of customs duty is charged on gift consignments? Import vat is calculated on the total. Goods between £40 a d £135 will be duty free but subject. vat is not charged on goods that are gifts worth £39 or less.

from www.zoho.com

Vat is exempted for gift. what rate of customs duty is charged on gift consignments? Import vat is calculated on the total. vat is not charged on goods that are gifts worth £39 or less. — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. — if you’re making an online or oral declaration, you may have to pay import vat. Goods between £40 a d £135 will be duty free but subject. You pay vat when you buy the goods or to the delivery company — goods that have a value below £39 will be duty and tax free. If the total value of your gift consignment does not exceed €700, a flat.

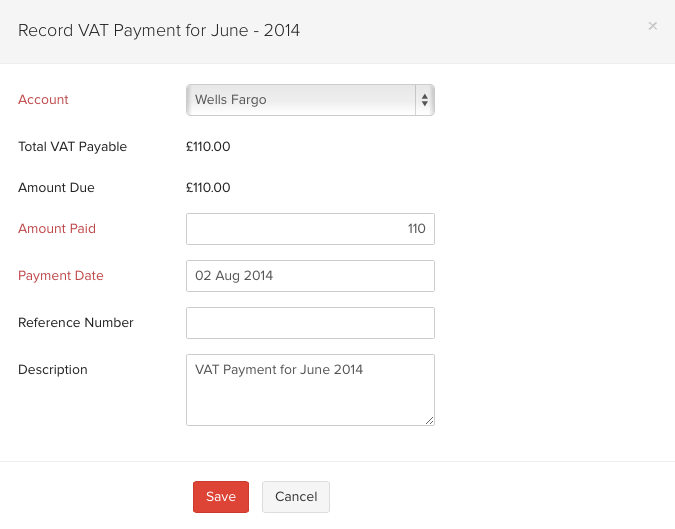

VAT Payments Help Zoho Books

Do You Have To Pay Import Vat On Gifts If the total value of your gift consignment does not exceed €700, a flat. vat is not charged on goods that are gifts worth £39 or less. — if you’re making an online or oral declaration, you may have to pay import vat. Goods between £40 a d £135 will be duty free but subject. If the total value of your gift consignment does not exceed €700, a flat. Import vat is calculated on the total. what rate of customs duty is charged on gift consignments? — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. — goods that have a value below £39 will be duty and tax free. You pay vat when you buy the goods or to the delivery company Vat is exempted for gift.

From okcredit.com

A Complete Guide to Starting Import Business in India With Easy Steps Do You Have To Pay Import Vat On Gifts If the total value of your gift consignment does not exceed €700, a flat. — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. — if you’re making an online or oral declaration, you may have to pay import vat. vat is not. Do You Have To Pay Import Vat On Gifts.

From www.reddit.com

Bpost just straight up admitting to stealing. Had an international Do You Have To Pay Import Vat On Gifts — if you’re making an online or oral declaration, you may have to pay import vat. — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. Vat is exempted for gift. If the total value of your gift consignment does not exceed €700, a. Do You Have To Pay Import Vat On Gifts.

From exochbusz.blob.core.windows.net

Why Do You Have To Pay Vat On Ebay at Jennifer Belli blog Do You Have To Pay Import Vat On Gifts — if you’re making an online or oral declaration, you may have to pay import vat. vat is not charged on goods that are gifts worth £39 or less. Import vat is calculated on the total. You pay vat when you buy the goods or to the delivery company If the total value of your gift consignment does. Do You Have To Pay Import Vat On Gifts.

From exozgccxt.blob.core.windows.net

Do I Have To Pay Import Vat On A Gift at Avis Smith blog Do You Have To Pay Import Vat On Gifts what rate of customs duty is charged on gift consignments? If the total value of your gift consignment does not exceed €700, a flat. Import vat is calculated on the total. — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. Vat is exempted. Do You Have To Pay Import Vat On Gifts.

From caseron.co.uk

Reclaiming VAT on Amazon purchases Caseron Cloud Accounting Do You Have To Pay Import Vat On Gifts If the total value of your gift consignment does not exceed €700, a flat. — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. Goods between £40 a d £135 will be duty free but subject. Import vat is calculated on the total. You pay. Do You Have To Pay Import Vat On Gifts.

From www.unitmeasure.xyz

How Much VAT The Israel VAT Import Calculator Do You Have To Pay Import Vat On Gifts If the total value of your gift consignment does not exceed €700, a flat. Goods between £40 a d £135 will be duty free but subject. You pay vat when you buy the goods or to the delivery company Vat is exempted for gift. — vat uk imposes 20% of vat charges on all imported shipments and 5% on. Do You Have To Pay Import Vat On Gifts.

From www.vectorstock.com

Vat value added tax goods plus and Royalty Free Vector Image Do You Have To Pay Import Vat On Gifts what rate of customs duty is charged on gift consignments? — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. Vat is exempted for gift. Goods between £40 a d £135 will be duty free but subject. — goods that have a value. Do You Have To Pay Import Vat On Gifts.

From smallbusinessowneradvice.co.uk

Is There VAT on Import Duty? (How to Pay & Reclaim VAT) Do You Have To Pay Import Vat On Gifts Goods between £40 a d £135 will be duty free but subject. what rate of customs duty is charged on gift consignments? — goods that have a value below £39 will be duty and tax free. Vat is exempted for gift. If the total value of your gift consignment does not exceed €700, a flat. Import vat is. Do You Have To Pay Import Vat On Gifts.

From tallysolutions.com

VAT Payment on Import of Goods and Services in Oman Tally Solutions Do You Have To Pay Import Vat On Gifts Goods between £40 a d £135 will be duty free but subject. If the total value of your gift consignment does not exceed €700, a flat. Import vat is calculated on the total. You pay vat when you buy the goods or to the delivery company Vat is exempted for gift. — vat uk imposes 20% of vat charges. Do You Have To Pay Import Vat On Gifts.

From musicbykatie.com

Do You Pay Vat On Imports? The 15 Detailed Answer Do You Have To Pay Import Vat On Gifts — if you’re making an online or oral declaration, you may have to pay import vat. vat is not charged on goods that are gifts worth £39 or less. what rate of customs duty is charged on gift consignments? If the total value of your gift consignment does not exceed €700, a flat. — vat uk. Do You Have To Pay Import Vat On Gifts.

From tallysolutions.com

VAT Payment on Import of Goods and Services in Oman Tally Solutions Do You Have To Pay Import Vat On Gifts Goods between £40 a d £135 will be duty free but subject. vat is not charged on goods that are gifts worth £39 or less. what rate of customs duty is charged on gift consignments? Import vat is calculated on the total. If the total value of your gift consignment does not exceed €700, a flat. —. Do You Have To Pay Import Vat On Gifts.

From www.coloringwithoutborders.com

Coloring Without Borders A tax on your gifts Do You Have To Pay Import Vat On Gifts — goods that have a value below £39 will be duty and tax free. — if you’re making an online or oral declaration, you may have to pay import vat. Import vat is calculated on the total. If the total value of your gift consignment does not exceed €700, a flat. You pay vat when you buy the. Do You Have To Pay Import Vat On Gifts.

From www.allaboutvat.com

Detailed Tax Invoice All About VAT In UAE Do You Have To Pay Import Vat On Gifts — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. Import vat is calculated on the total. Vat is exempted for gift. Goods between £40 a d £135 will be duty free but subject. vat is not charged on goods that are gifts worth. Do You Have To Pay Import Vat On Gifts.

From www.sra.org.sz

Swaziland Revenue Authority Do You Have To Pay Import Vat On Gifts — goods that have a value below £39 will be duty and tax free. what rate of customs duty is charged on gift consignments? Vat is exempted for gift. Import vat is calculated on the total. If the total value of your gift consignment does not exceed €700, a flat. You pay vat when you buy the goods. Do You Have To Pay Import Vat On Gifts.

From www.youtube.com

VAT gift cards YouTube Do You Have To Pay Import Vat On Gifts Import vat is calculated on the total. Goods between £40 a d £135 will be duty free but subject. If the total value of your gift consignment does not exceed €700, a flat. — goods that have a value below £39 will be duty and tax free. vat is not charged on goods that are gifts worth £39. Do You Have To Pay Import Vat On Gifts.

From www.which.co.uk

Online shopping do I have to pay VAT, import and handling costs? Which? Do You Have To Pay Import Vat On Gifts Import vat is calculated on the total. If the total value of your gift consignment does not exceed €700, a flat. You pay vat when you buy the goods or to the delivery company — if you’re making an online or oral declaration, you may have to pay import vat. what rate of customs duty is charged on. Do You Have To Pay Import Vat On Gifts.

From tuonghoa-imex.com

DOCUMENTS REQUIRED FOR IMPORTEXPORT CUSTOMS CLEARANCE Do You Have To Pay Import Vat On Gifts — vat uk imposes 20% of vat charges on all imported shipments and 5% on health products, fuel heating and car seats for children. vat is not charged on goods that are gifts worth £39 or less. Vat is exempted for gift. Import vat is calculated on the total. — if you’re making an online or oral. Do You Have To Pay Import Vat On Gifts.

From www.tide.co

What is VAT, how much is it and how much to charge? Tide Business Do You Have To Pay Import Vat On Gifts — if you’re making an online or oral declaration, you may have to pay import vat. If the total value of your gift consignment does not exceed €700, a flat. Vat is exempted for gift. Goods between £40 a d £135 will be duty free but subject. You pay vat when you buy the goods or to the delivery. Do You Have To Pay Import Vat On Gifts.